Inventory management can play a key role in maintaining higher working capital. While it’s not a major issue in the long term, stockpiling can lead to short-term cashflow problems. But when you overcommit, it can be hard to shift the product. Keeping an inventory is essential for any product-based business. So, optimize your accounts payable and negotiate terms in order to access working capital and build a good business credit history. But repaying accounts on time is incredibly important. This frees up working capital to fuel business growth.Įach industry has different operations standards when it comes to days payable outstanding.

As a start-up, having a high days payable outstanding is beneficial as it means you are utilizing the entirety of the credit period. Increase Days Payable Outstandingĭays payable outstanding refers to the number of days a company goes before settling its account. Managing this will directly lead to higher working capital. To incentivize customers into upfront payments, offer a discount or set expectations in your client agreement. While deferred revenue will appear as a liability on your accounts statements, it can be a great method of generating credit. Offer Deferred Revenue Incentivesĭo any of your customers pay you prior to receiving your services? Deferred payments increase your capital and provide your company with up-front cashflow. However, there are steps you can take right now to implement a strategy around improving your company’s working capital turnover. It can be useful to track the working capital turnover ratio over the short term (for example, on an annual basis) as this will allow management to calculate improvements over the given period.

#Working capital turnover adalah how to#

How to improve your Working Capital Turnover Ratio This indicates that those who do not have a strategy around improving their working capital turnover are at risk of being left behind.Ī high working capital turnover is important for showing that a company is utilizing its working capital in the most efficient way. However, this number has been relatively flat in the past 5 years. In North America, corporations have averaged a 2% year-on-year increase in working capital. While it’s not ideal, there are a number of ways to overcome this and later generate a high turnover ratio. Some startups, however, may have calculated their working capital turnover ratio to be in the negatives. A higher ratio indicates a strong financial outlook for your company, as the funds spent have generated an ideal number of net sales over the period. The goal here is to have a high ratio of working capital turnover.

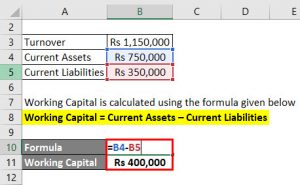

What your Working Capital Turnover Ratio Means Therefore, we are really looking at how you make the spare capital work, and whether it’s generating enough sales to cover your liabilities. In this way, the amount of sales is directly related to the company’s current assets and liabilities. Net Sales / (Total Assets minus Total Liabilities) The working capital turnover ratio formula is as follows: How to Calculate your Working Capital Turnover RatioĬalculate working capital by subtracting current liabilities from current assets. A higher-than-average working capital turnover ratio indicates that every pound (or dollar) of working capital spent delivers a better return in net sales.Įven better, you can compare the calculation for your working capital turnover with that of your competitors in the same industry. In reality, the ratio measures how efficiently your money is working to generate more capital. This is known as the working capital turnover ratio. Working capital turnover compares the proportion of net sales to working capital. Therefore, calculating the current and expected working capital turnover ratios could be key in securing that funding. Alternatively, companies may choose to pledge working capital towards new machinery or software, for example.Ī start-up often requires outside funding to generate enough working capital to support its sales growth. It may be spent on improving the efficiency of internal operations and processes. Therefore, working capital is the ‘spare cash’ left over to be re-invested into the business in order to boost sales. On the other hand, liabilities refer to what your company owes, including accounts payable and salaries. As a quick recap, assets refer to what your company owns, such as cash and stock. Working capital is composed of your current assets minus current liabilities. It refers to the amount of money spent to improve net sales after bills and debts are paid. Working capital is essential for any business, whether you are part of a start-up, family business, or well-established international corporation.

0 kommentar(er)

0 kommentar(er)